Creaspac

Creaspac’s overall acquisition strategy is to seek to acquire a company with significant potential for revaluation and ability to generate profit growth taking risk into account. Potential target companies primarily include Nordic, unlisted companies that operate in markets that are undergoing change, with a potential for revaluation and opportunity to generate profit growth, and with an enterprise value of approximately SEK 2-5 billion (excluding indebtedness).

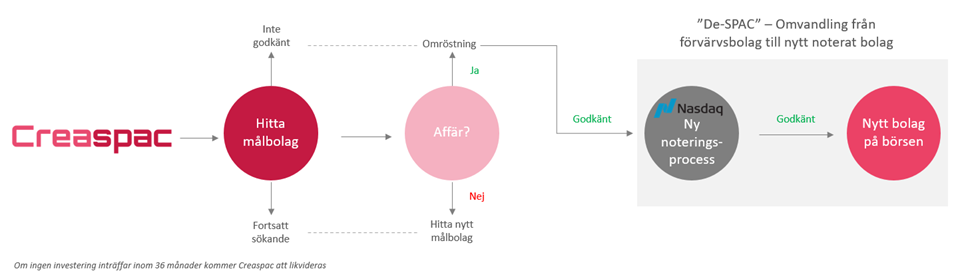

Creaspac´s diffrent phases as a SPAC

Illustrated below are the different phases of a SPAC up until an acquisition has been completed.

Identifying and evaluating a potential target company

Creaspac will work actively to find target companies that the Company deems suitable for further development in a listed environment. Furthermore, Creaspac expects that different actors will contact Creaspac or its sponsor Creades after the completion of the Offering. Creades will also work, through its network of, among others, owners, entrepreneurs, senior executives of listed and unlisted companies, consultants and other transaction advisers, to find an interesting company that fits the acquisition criteria that Creaspac has resolved.

Resolution by the general meeting

Before an acquisition can be completed, the board must submit a proposal for the acquisition at a general meeting, where support from the shareholders is required by a simple majority, i.e. that more than half of the votes cast at the meeting must approve the acquisition. Shareholders who vote against such an acquisition will, under certain conditions, have the right to have their shares redeemed, as further described below. Before such a general meeting, the board will produce and publish information material to serve as a basis for the resolution, so that the shareholders can make well-informed decisions as to whether or not to approve the proposed acquisition. If several companies are intended to be acquired, such acquisitions shall be resolved upon at the same general meeting in order for the review process at Nasdaq Stockholm or Nasdaq First North Growth Market regarding these companies to be initiated.

Review process

Once Creaspac has entered into an acquisition agreement, Creaspac must initiate a review process at Nasdaq Stockholm or Nasdaq First North Growth Market in order for the acquired business to be approved for listing and the acquisition to be completed (provided that the general meeting has approved such acquisition, see above), and Creaspac will thus be moved from the SPAC segment to Nasdaq Stockholm’s main market or Nasdaq First North Growth Market. During this period, Creaspac’s shares will have observation status, but trading in the Company’s shares will continue as usual. The observation status will remain until the review is completed. The acquired business will thus need to meet Nasdaq Stockholm’s or Nasdaq First North Growth Market’s listing requirements and be approved by Nasdaq Stockholm’s listing committee or Nasdaq Stockholm’s Surveillance Function in order for Creaspac to be able to gain access to the shares in the target company while continuing to be listed on Nasdaq Stockholm or be listed on Nasdaq First North Growth Market.

Completion of an acquisition

Following the fulfilment of the conditions precedent in the acquisition agreement entered into with the sellers of the target company, including approval by the general meeting in Creaspac and approval by Nasdaq Stockholm or Nasdaq First North Growth Market, Creaspac will be able to complete the acquisition and access the shares in the acquired company. The target company will thereafter constitute a wholly owned subsidiary of Creaspac where the business will be conducted with the potential to create value for the shareholders.